Billions of real-world, asset-backed NFTs are coming to enable the next killer Web3 use case

New York, New York — Oct. 14, 2022 — Vera Labs, the fintech company behind the decentralized finance (DeFi) protocol for nonfungible tokens (NFT) that demonstrated the of a million dollar cartoon “Bored Ape Yacht Club” NFT last year, has signed an exclusive agreement with Lux Partners to bring billions of dollars worth of precious metals and resources on-chain, beginning with uranium-backed NFTs.

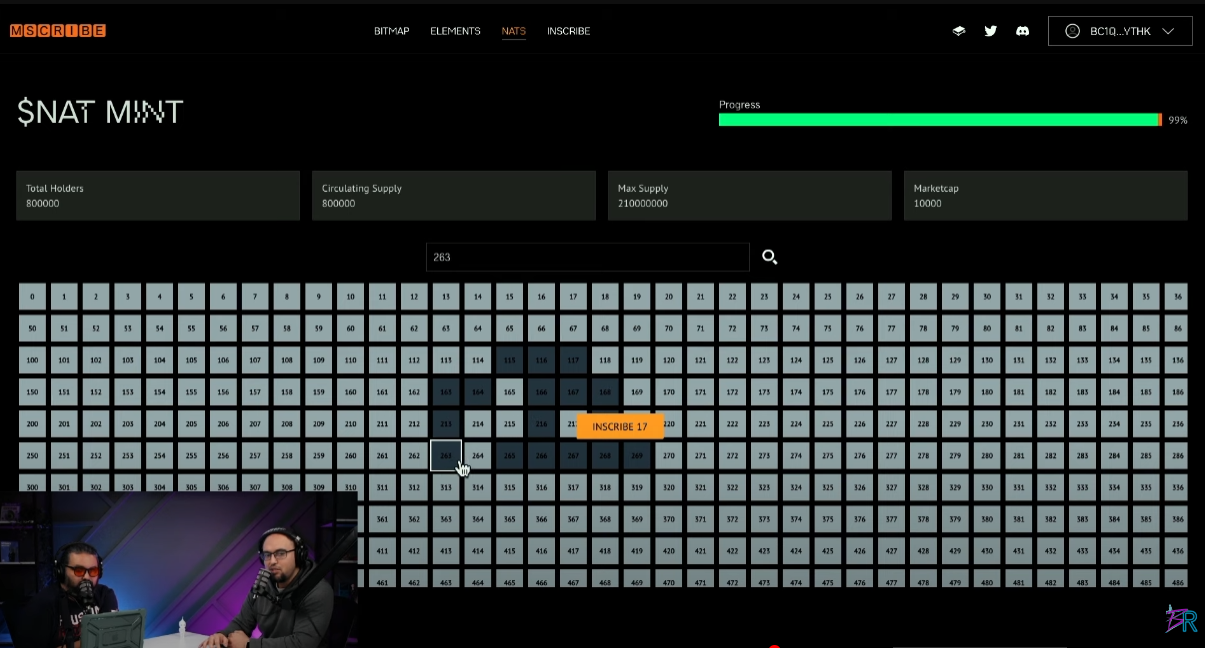

Vera will become the first decentralized protocol to allow sales of tokenized, real-world assets such as Lux’s uranium-backed NFTs, unlocking billions of dollars worth of new liquidity and utility never before seen in Web3. The NFTs will be available for sale starting Oct. 15 at , and customers purchasing them with $VERA coins will enjoy a 10% discount.

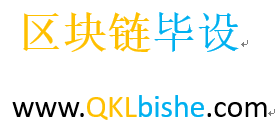

Asset-backed NFTs are an example of a growing trend in the NFT space. Industry experts predict NFTs with real-world value and utilities are here to stay and will drive mass adoption of Web3 into the millions of users. Meanwhile, so-called cartoon NFTs have since the start of 2022.

“Asset-backed stablecoins such as Tether or USDC accelerated the mass adoption of decentralized finance, the first killer use case of Ethereum Virtual Machine-compatible applications,” explained Denis Lam, CEO of Vera Labs. “Likewise, asset-backed financial NFTs will be the driver of the next NFT killer use case, and we are excited to partner with Lux to pioneer this vision.”

“Imagine someone who believes in a real-world asset such as gold and wants the asset part of their retirement plan,” explains Michael Arbach, CTO of Vera Labs. “Using Vera’s non-custodial, self-executing financing smart contracts that support the redemption of physical assets, the investor can buy a $1 million gold NFT today and pay for it over 20 years without going through an escrow or intermediary, saving thousands of dollars in middleman fees. This unlocks billions of dollars of new business opportunities that are not possible today.”

Zach Kelling, CEO of Lux Partners, stated, “We are pleased to form a strategic alliance with Vera Labs to enable decentralized financial applications powered by Lux asset-backed NFTs. True assets must do more than buy, sell or hold, and Vera is the holy grail to enable noncustodial and compliant business transactions for our NFTs, with minimal legal overhead and a fixed or negligible transaction fee whether the asset is worth $100 or $1 billion dollars.”

Lux Uranium provides a convenient, secure and easy-to-use investment alternative for modern investors interested in holding uranium, backed by verified reserves of an increasingly valuable resource. With a global market that exceeds $10 billion dollars, uranium is the most important natural resource for nuclear power generation and is only found in abundance in certain areas of the world. One uranium fuel pellet creates as much energy as one ton of coal, 149 gallons of oil or 17,000 cubic feet of natural gas.

Recently, Lux signed a with Madison Metals who will provide the delivery of up to 20 million pounds of U3O8 from their worldwide uranium projects.

To learn more about Lux Uranium, explore:

To learn more about Vera Labs, explore:

About Vera Labs

Vera Labs is a United States fintech company behind the development of Vera, a DeFi protocol that enables rentals, lending, and buy now pay later for NFTs on any blockchain. Vera’s vision is to increase the gross domestic product of Web3 and empower communities by allowing anyone to easily share and monetize their NFTs. If Bitcoin () is the new digital currency for electronic cash payments that replaces the need for banks, then Vera coin is the new digital currency for NFT transactions that replace the need for escrows or intermediaries. Vera Labs enables brands, creators, metaverses and institutions to implement utility and DeFi use cases with NFTs such as memberships and loyalty programs in a retail consumer-friendly and compliant manner. Vera executives have an extensive track record of developing blockchain technologies for a wide range of clients such as NASA, Northern Trust, Daikin, Barett Jackson and Hollywood Oscar Award-winning actors. Additional information can be found at .

About Lux Partners

Lux is a fintech company domiciled in the Isle of Man and partnered with a regulated and licensed money transmitter business. Lux enables institutions to take advantage of blockchain technology use cases in a tax-advantaged and regulated environment, with proper compliance, Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. Lux executives have an extensive track record of managing transactions and investments across a wide range of industries. Institutions and governments alike can send and receive tokenized assets, with proper compliance, KYC and AML procedures. Lux processes transactions in crypto and fiat, given its ability to process SWIFT and U.S. Federal Reserve wires natively from the blockchain while still providing the highest levels of security and privacy thanks to the Lux Bridge, which uses zero-knowledge proofs to secure assets and enable private transactions over the Lux Network. Lux is uniquely positioned to launch a multitude of highly profitable and risk-weighted verticals that are exceedingly scalable within sizable and fast-growing markets. These verticals include secure transaction processing, asset management, DeFi ecosystems and tokenized investments in natural resources and emerging markets. Additional information can be found at .

For further information, please contact:

Media Inquiries:

Shaun Saunders

Graffiti Creative Group

Email:

Denis Lam

Executive Chairman & CEO

Vera Labs Inc.

+1 (360) 230-8888